when does current estate tax exemption sunset

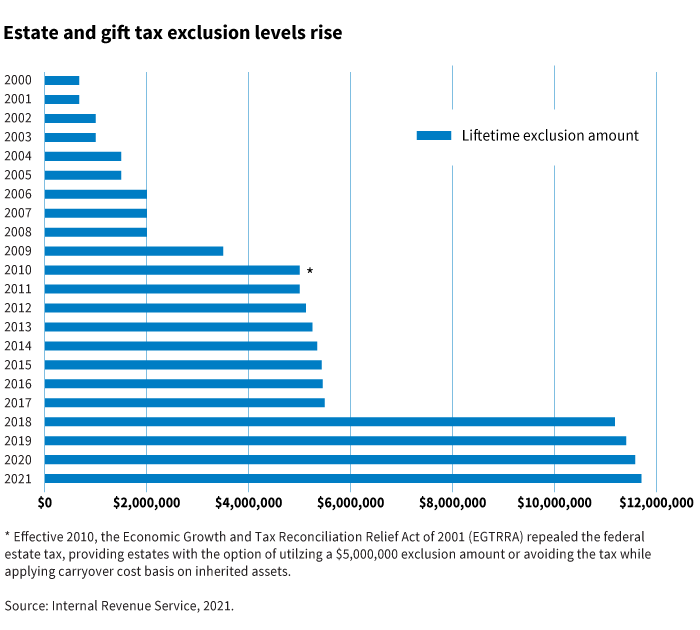

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with. Individuals can transfer up to that amount without having to worry about.

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Ohio Estate Tax Sunset Provision 2021.

. This increase in the estate tax exemption is set to sunset at the end. The federal estate tax exemption for 2022 is 1206 million. The Federal Estate Tax Exemption.

The current estate tax exemption is set to expire at sunset in 2025 at which time it could revert to the pre-2018 exemption level of 5 million for an individual taxpayer. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. What happens to estate tax exemption in 2026.

For instance a married. Effective January 1 2022 no Ohio estate tax is. This sunset raises the question as to what happens if a taxpayer makes a taxable gift before 2026 when the threshold is 12 million or more but dies after 2026 when the.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. The current estate and gift tax exemption is scheduled to end on the last day of 2025. The estate tax exemption is often adjusted annually to reflect changes in inflation every year.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added. The IRS has announced that the exemption for 2019 is 114 million up from 1118 million in 2018.

How did the tax reform law change gift and estate taxes. This gives most families plenty of estate planning leeway. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes.

After that the exemption amount will drop back down to the prior laws 5 million cap. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. After 2025 the exemption amount will sunset a fancy way of.

You can gift up to the exemption amount during life or at death or some combination thereof. If you believe you will be. Because the BEA is adjusted annually for inflation the 2018.

In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple. Under current law the estate and gift tax exemption is 117 million per person. The current estate tax exemption is 12060000 and double that amount for married couples.

Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The tax reform law doubled the BEA for tax-years 2018 through 2025. Starting January 1 2026 the exemption will return to 549 million.

The current tax rates of the Tax Cuts Jobs Act will be sunsetting in 2026 meaning tax rates will be going back up to the rates from 2017. So how does this affect you. Adjusting for inflation the current exemption this year is 1158 million the highest it has ever been.

Fast-forward to 2026 and the estate and gift tax exemption.

Farmers Ranchers Need Permanent Fix For Estate Tax Texas Farm Bureau

Florida Attorney For Federal Estate Taxes Karp Law Firm

2021 Federal Gift Estate Tax Exemption Update Sessa Dorsey

A New Era In Death And Estate Taxes

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

Three Estate Planning Strategies For 2021 Putnam Investments

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Law Money Matters

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Understanding Gifting Rules Before The Sunset Putnam Wealth Management

Federal Estate Tax Exemption 2021 Cortes Law Firm

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Estate Tax Exemptions Update 2019 Fafinski Mark Johnson P A

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Duckett Law Office

Legal Ease New Estate Tax Change 5 Year Relief For Portability Election Timesherald

High Net Worth Families Should Review Their Estate Plans Pre Election

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation